Analysts Say Micron Has ‘More Room to Run.’ Should You Buy MU Stock Here?

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)

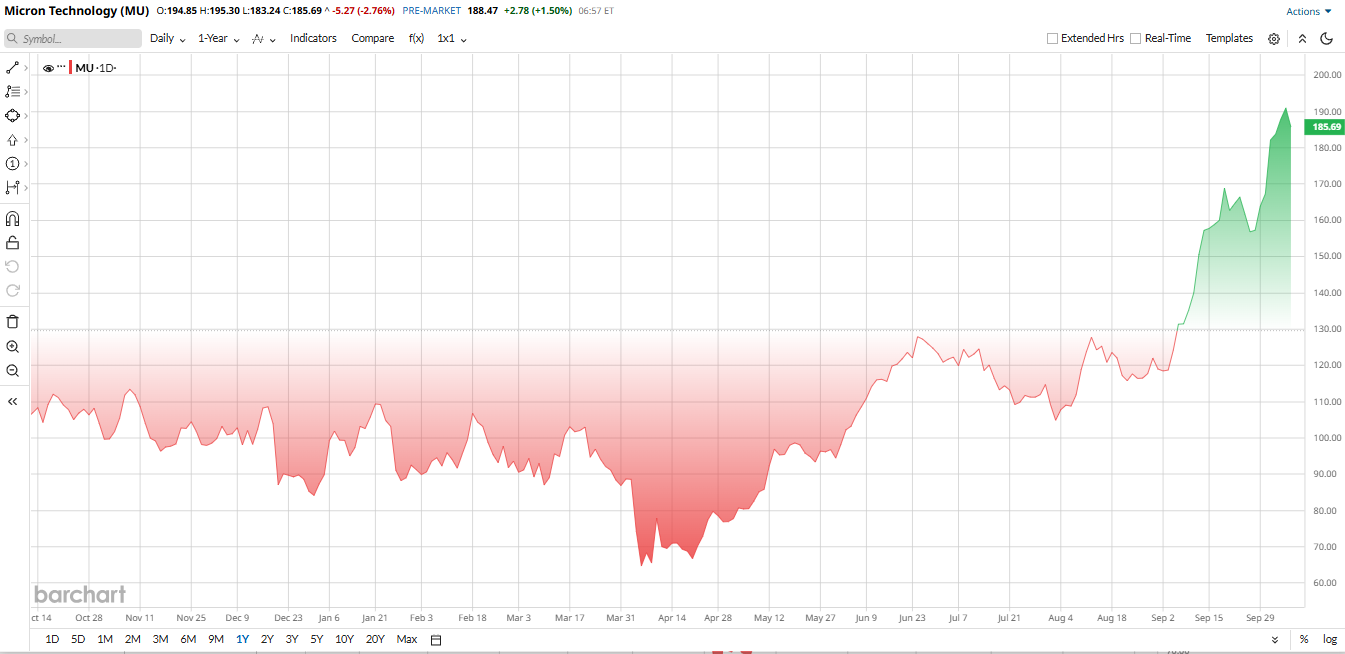

This year, semiconductor stocks have been on a bull run as investors flock to anything to do with artificial intelligence (AI) and its unending demand for more data centers. Four years ago, the memory chip market had become glutted due to suspected excess capacity and dropping prices. Now, things look like they're turning around. Investors are realizing that memory chips play a key role in AI servers and that state-of-the-art graphics processors require high-bandwidth memory (HBM) solutions.

One of the biggest beneficiaries was Micron Technology (MU), one of the most common suppliers of DRAM and NAND memory chips. Morgan Stanley has recently become bullish on the stock, increasing its price target to $220 and rating it “Overweight.” Analysts cite several quarters of double-digit price gains and deepening market fundamentals in the DRAM market.

Investors who are asking whether it is already too late to invest in Micron need to take a closer look at the body behind MU stock and whether it still has a lot to offer.

About MU Stock

Valued at roughly $208 billion, Micron Technology is a prominent memory and storage solutions provider and a leading global maker of memory chips. The company tends to move in step with the semiconductor industry's boom-and-bust cycles.

Micron has been one of 2025’s standout performers, more than doubling in price so far this year. The surge reflects booming demand for DRAM and high-bandwidth memory (HBM) to power AI data centers, coupled with tight supply. As Morgan Stanley noted in early October, “conviction from our purchasing contacts is very high,” saying it “sees more room to run.” In short, major tech trends, from Nvidia's (NVDA) and AMD's (AMD) AI chip launches to hyperscaler restocking, are fueling Micron’s rally.

Despite the surge, Micron’s valuation remains relatively modest. The stock trades at a price-to-earnings (P/E) ratio of about 12, well below the sector average of 33. Its forward PEG ratio stands near 0.2, a level that typically signals the shares may still be undervalued relative to future growth prospects.

Micron Beats Earnings Estimate

Micron Technology has delivered record-breaking quarterly results, driven by strong demand for its memory solutions, positioning it well for continued growth in AI-driven markets. In Q4, revenue hit $11.32 billion, up 46% year-over-year (YoY), and GAAP net income was $3.20 billion, or $2.83 per share. This more than tripled the prior-year profit.

MU boasts exceptional profitability, with an EBITDA margin of 49% versus the sector's 11%. Net income margin is 23%, significantly higher than the sector's 4%, exemplifying efficient profit conversion.

For the full year, Micron generated $37.38 billion in revenue, a roughly 49% increase from FY2024, with EPS of $7.59. The primary driver was booming data center demand, particularly for AI-oriented memory products. DRAM revenues surged nearly 68% to $8.94 billion in Q4, while overall profits swelled by about 3.6x as Micron ramped up production to meet record-high demand. Capital expenditures rose to around $4.9 billion for the quarter, underscoring its heavy investment in capacity expansion.

Looking ahead, management remains confident. Micron expects Q1 FY2026 revenue of around $12.5 billion with non-GAAP gross margins near 51%, signaling another 40 to 45% annual growth.

The company’s CEO noted that Micron is entering FY2026 “with strong momentum and our most competitive portfolio to date,” driven by record data-center performance and rising AI chip adoption. Moreover, a quarterly dividend of $0.115 per share is also set for payment on Oct. 21.

AI Boom Turns Micron Into a Key Memory Powerhouse

Micron has emerged as a major player in the AI revolution, driven by surging demand for high-bandwidth memory chips crucial to AI servers and accelerators from companies like Nvidia, Oracle (ORCL), and OpenAI. The company generated roughly $2 billion in HBM sales in the fourth quarter of fiscal 2025 and is preparing to launch its advanced HBM4 chips.

Nearly all of Micron’s 2026 HBM3 supply is already booked, and the company sells every chip it produces. Strong demand for HBM and DRAM lifted quarterly revenue 46% to $11.3 billion, while margins and earnings climbed sharply.

What Do Analysts Say About MU Stock?

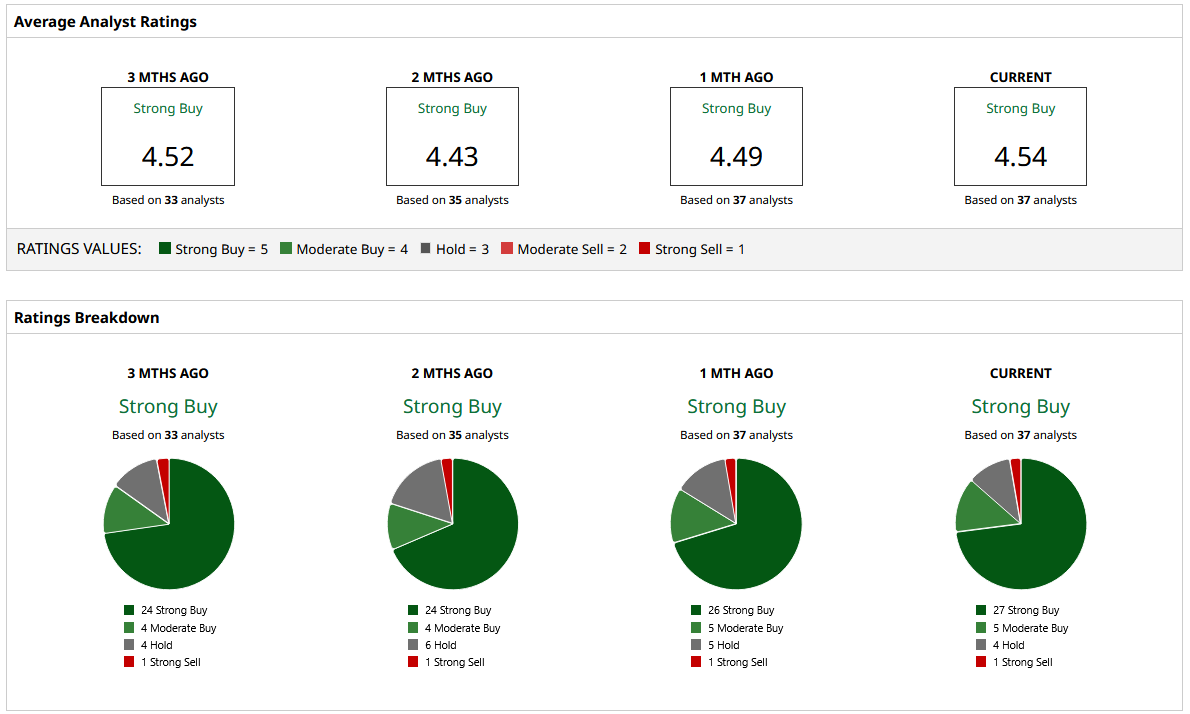

Wall Street has become largely bullish on MU. As mentioned earlier, Morgan Stanley upgraded MU to “Overweight,” citing high “conviction” from purchasing contacts as HBM demand tightens. Analysts noted that despite Micron’s strong rally, the stock still has upside as earnings estimates keep rising.

Similarly, J.P. Morgan and UBS set targets near $185 and kept "Overweight" ratings, pointing to sustained AI-driven memory demand and firmer DRAM/HBM pricing.

Separately, Stifel Nicolaus raised its target to $195 in September, highlighting strong HBM momentum, margin expansion, and data center restocking.

Overall, covered by 37 Wall Street analysts, Micron has a consensus “Strong Buy” rating. The stock just surpassed its mean price target of $185 and is marching towards its street high target of $250, which is about 33% above the current price. Together, these calls show analysts see Micron well-positioned to benefit from accelerating AI infrastructure spending. MU stock certainly seems to have “more room to run.”

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.