As SoundHound Announces New Apivia Deal, Should You Buy, Sell, or Hold SOUN Stock?

/A%20corporate%20sign%20for%20SoundHound%20by%20Tada%20Images%20via%20Shutterstock.jpg)

SoundHound AI (SOUN) is extending gains today after announcing an artificial intelligence (AI) deal with Apivia Courtage, a subsidiary of Paris-headquartered AEMA Group.

The voice AI firm has teamed up with Apivia to bring its Amelia 7.0 platform to its contact centers. Note that SOUN has been working with the French company since 2023.

Following today’s surge, SoundHound stock is up nearly 170% versus its year-to-date low in April.

How Apivia Partnership Helps SoundHound Stock

The extended partnership with Apivia is meaningfully positive for SOUN stock mostly because it signals potential for a significant increase in Amelia 7.0 revenue over the long term.

SoundHound’s artificial intelligence agents have already been tested across Apivia contact centers, where they delivered a 20% boost to overall productivity.

This confirmed track record of driving tangible business value instills strong investor confidence.

A major insurance group deepening commitment to Amelia’s advanced, autonomous capabilities suggests SOUN is a leader in the rapidly evolving enterprise conversational AI market.

This could attract other large-scale clients in insurance and the financial services industry, directly accelerating the firm’s top line and scaling its enterprise footprint, all of which could help sustain upward momentum in SoundHound shares.

Does the Acquisition Spree Warrant Buying SOUN Shares?

SoundHound’s acquisition spree reinforces its commitment to rapid growth, potentially emerging as a leader in the global voice AI market.

In September, the Nasdaq-listed firm announced a $60 million acquisition of Interactions to unlock cross-selling opportunities while fast-tracking its path to profitability as well.

SOUN is bringing complementary technologies under its umbrella to build a defensible moat and make its stretched valuation of more than 85 times sales more acceptable for long-term investors.

Note that the company’s growth-by-acquisitions strategy seems to be working out already, given its revenue more than tripled on a year-over-year basis to $42.7 million in its fiscal Q2.

The top-line strength is what has driven SoundHound shares to new highs in 2025.

SoundHound Has Surpassed the Street-High Price Target

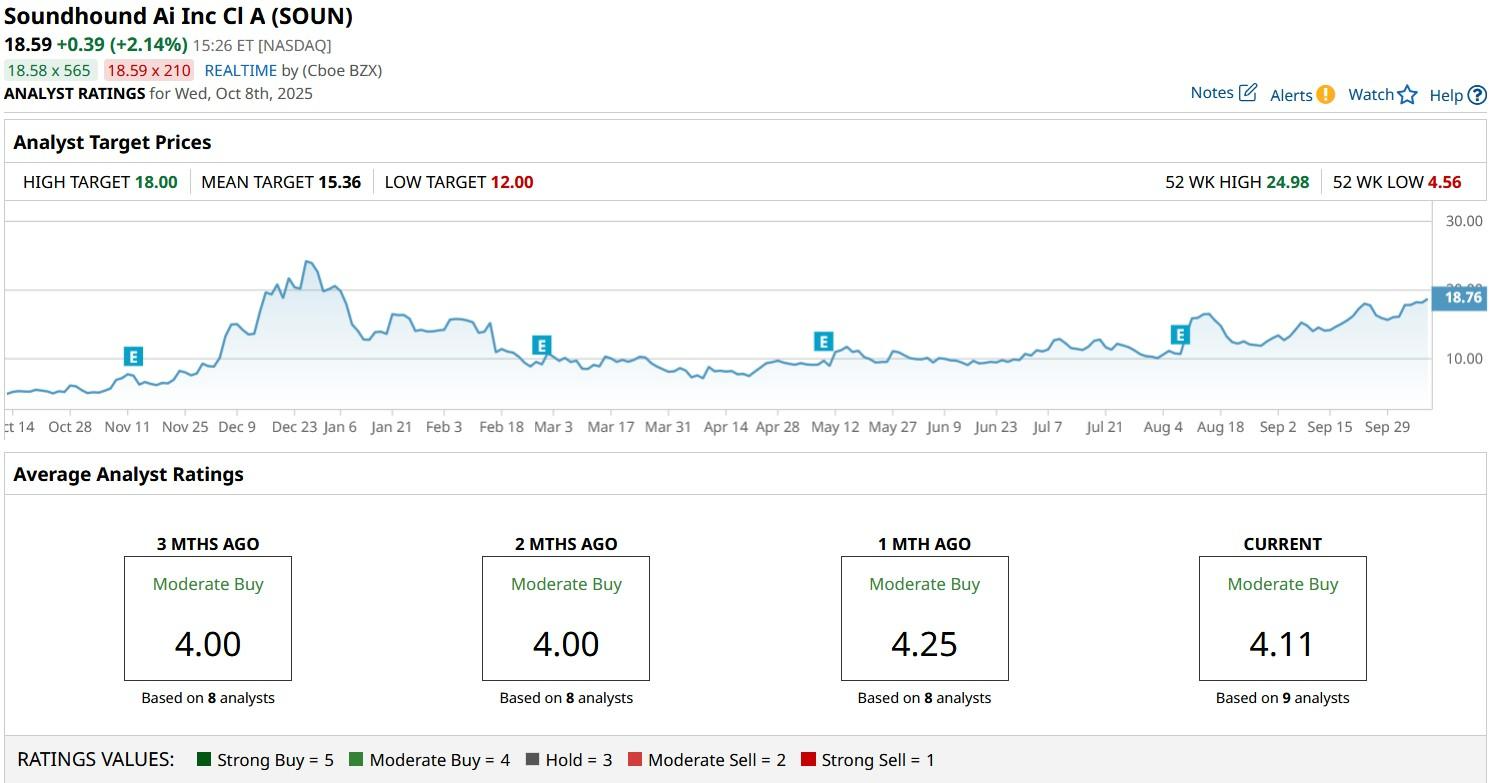

What’s also worth mentioning is that Wall Street firms currently have a consensus “Moderate Buy” rating on SOUN shares.

However, SoundHound stock has already surpassed the Street-high price target of $18.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.