As Jeff Bezos Warns of an ‘AI Bubble,’ This Could Be the Safest Magnificent 7 AI Stock to Buy Now

/NVIDIA%20Corp%20logo%20on%20phone%20and%20AI%20chip-by%20Below%20the%20Sky%20via%20Shutterstock.jpg)

Amazon (AMZN) founder Jeff Bezos recently joined the growing chorus of voices calling out an AI bubble, but his take offers a surprisingly optimistic spin. Speaking at Italian Tech Week, Bezos acknowledged the market is experiencing what he called an "industrial bubble," where investors are funding both good and bad ideas indiscriminately.

The comparison to the dot-com crash worries many investors, but Bezos sees a crucial difference. Industrial bubbles, he argued, often produce lasting benefits for society even when individual companies fail.

He pointed to the biotech boom of the 1990s, which led to the development of life-saving drugs despite incurring billions in losses and numerous bankruptcies. Bezos emphasized that the bubble doesn't invalidate AI's transformative potential.

The technology is real and will impact every industry, he said, improving quality and productivity across companies worldwide. His own Amazon continues to bet big on AI, constructing data centers and developing custom chips to meet surging demand.

Goldman Sachs (GS) CEO David Solomon echoed similar concerns about market froth while acknowledging AI's powerful enterprise potential. OpenAI CEO Sam Altman previously warned that smart people get overexcited during bubbles but maintained that the economic upside would be substantial.

Nvidia Provides Both Safety and Opportunity

For investors seeking safety amid the AI frenzy, Nvidia (NVDA) stands out among the Magnificent 7. Over the last three years, Nvidia's stock has increased by 1,400%. Despite these outsized gains, NVDA stock trades at a reasonable forward price-to-earnings (P/E) multiple of 32.5x, which is above the 10-year average of 36.7x.

This relative valuation discount, combined with Nvidia's dominant position in AI infrastructure, suggests the company offers a more grounded entry point than other AI-related stocks trading at stratospheric valuations with minimal revenue to show for it.

The Bull Case for NVDA Stock

Nvidia continues to cement its position as the backbone of the AI revolution. It has recently announced several partnerships across various verticals, including quantum computing and robotics. The chipmaker unveiled breakthroughs across multiple fronts. In quantum computing, Nvidia's CUDA-X libraries are accelerating error correction and circuit optimization.

A collaboration with QuEra achieved a 50x increase in decoding speed using AI models, while partnerships with Oxford Quantum Circuits delivered speedups of up to 600x in quantum compilation tasks. These advances address critical bottlenecks preventing quantum hardware from reaching practical applications.

Nvidia also introduced the open-source Newton Physics Engine alongside Isaac GR00T N1.6, a new foundation model that brings humanlike reasoning to robots. The Newton engine, co-developed with Alphabet's (GOOG) (GOOGL) Google DeepMind and The Walt Disney Company's (DIS) Disney Research, enables developers to simulate complex robot actions, such as walking through snow or handling delicate objects.

Leading robotics companies, including Boston Dynamics, Figure AI, and Agility Robotics, are adopting these technologies. A few days back, OpenAI and Nvidia announced a historic partnership to deploy at least 10 gigawatts of Nvidia systems for OpenAI's next-generation infrastructure. Nvidia intends to invest up to $100 billion progressively as each gigawatt is deployed, with the first phase launching in late 2026 using the Vera Rubin platform.

CEO Jensen Huang described it as the largest AI infrastructure project in history. OpenAI CEO Sam Altman emphasized the partnership's importance, noting that the AI platform serves over 700 million users weekly and requires computational resources to meet the growing demand for advanced AI capabilities.

Finally, Nvidia announced a strategic collaboration with Intel to jointly develop x86 CPUs for data centers and custom PC chips integrating Nvidia GPUs. This partnership addresses roughly $50 billion in annual market opportunity across data centers and consumer PCs.

Nvidia CFO Colette Kress reiterated the company's view that data center infrastructure requirements could reach $3 trillion to $4 trillion by the end of the decade, underscoring the massive opportunity ahead as AI transforms every industry.

What Is the Target Price for NVDA Stock?

Nvidia is forecast to increase revenue from $130.5 billion in fiscal 2025 to $378 billion in fiscal 2030. Comparatively, adjusted earnings are forecast to expand from $2.99 per share to $9 per share in this period.

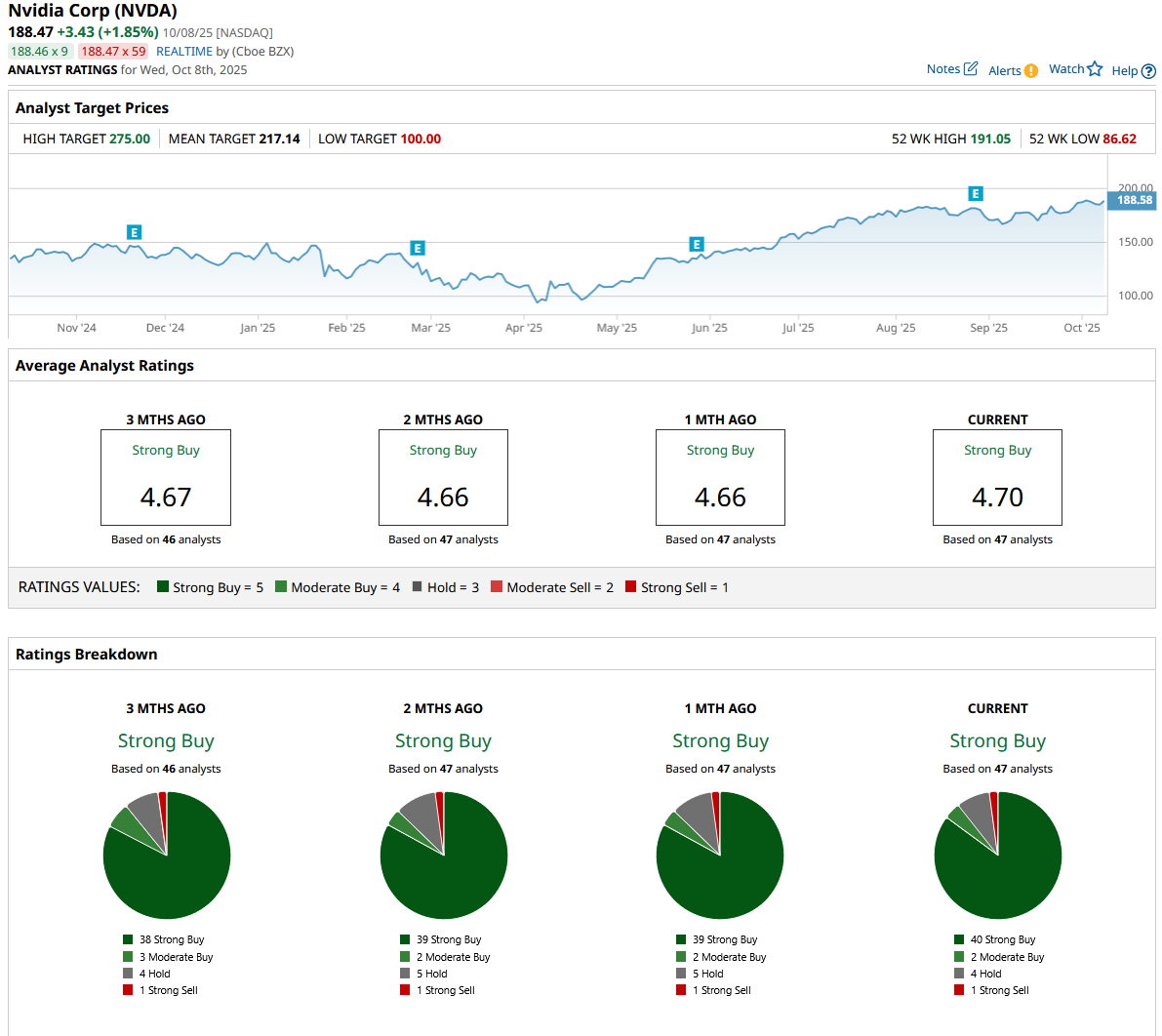

If NVDA stock is priced at 30x forward earnings, it could gain around 90% within the next four years. Out of the 47 analysts covering NVDA stock, 40 recommend “Strong Buy,” two recommend “Moderate Buy,” four recommend “Hold,” and one recommends “Strong Sell.” The average NVDA stock price target is $217, above the current price of $188.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.