Don’t Doubt the Dow 30. These 3 Stalwart Stocks Are Flashing Signals of Gains Ahead.

I’m old enough to remember when the Dow Jones Industrial Average ($DOWI) still mattered. And even though artificial intelligence and the S&P 500 Index ($SPX) steal the spotlight these days, I still think the Dow tells us something important. Namely, the degree to which anything else in the U.S. stock market has a shot of delivering profits for traders.

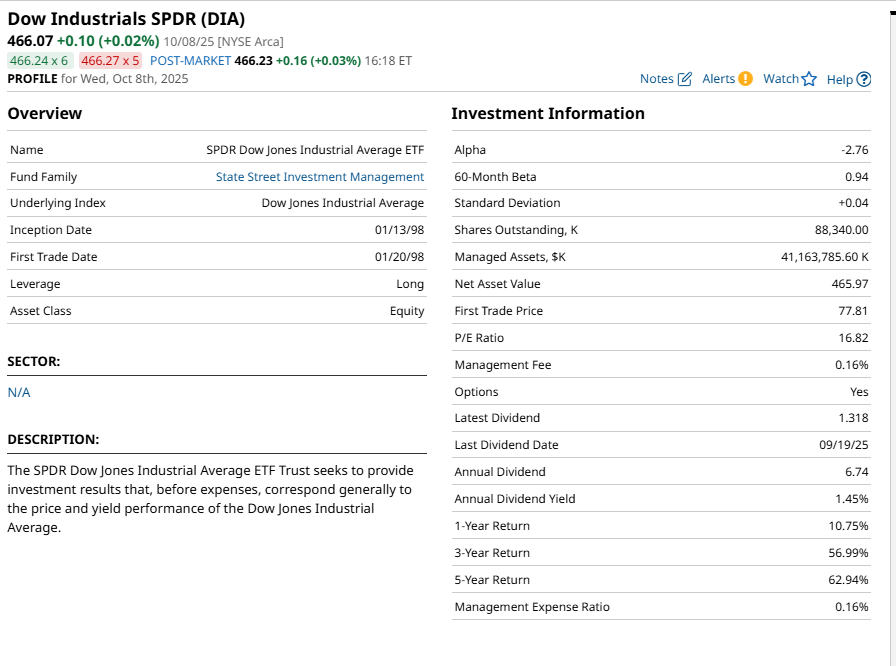

The Dow is best represented in ETF form by the SPDR Dow Jones Industrials ETF (DIA). State Street Investment Management runs it, and they made a great decision back in 1998, when five years after the first-ever ETF was launched to track the S&P 500 (SPY), they debuted DIA. It is a $41 billion ETF now. And it tracks the 30 stocks in the index that was created back in the 1800s, and which served as the home of the great stocks that were part of the U.S. industrial revolution. Not to mention the big business that helped the free world stay that way in World War II.

Thanks for Nothing!

Yet when we fast-forward to the current market, the Dow is thought of more as a cute, old-fashioned way used to track the market. That’s to be expected with an index that is structured by its committee to try to reflect the broader U.S. economy as it is. Not what many hope it will be 5-10 years from now, when AI “revolutionizes” our lives.

Why Is the Dow Still Important?

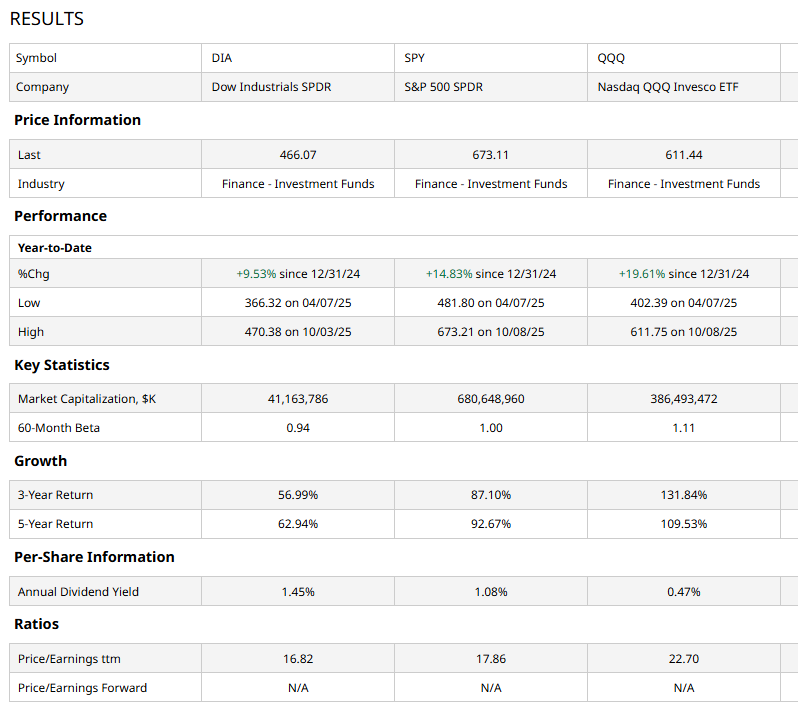

And as a corollary to that question, why should traders and investors care about a broad stock market ETF that has underperformed the way DIA has? By a whopping 30% versus SPY and more than 45% versus the Invesco QQQ Trust (QQQ). Sure, it sells a valuation discount to those two, but why spend any time looking at a laggard?

First, a reminder that markets are cyclical. Very cyclical. And as I like to remind traders about past performance, it only guarantees one thing: You can’t have it! So to me, trailing returns mean almost nothing.

DIA’s much higher yield versus SPY is also an indication that there’s a possible case of a forgotten blue-chip index which could have its part of the cycle approaching.

However, my main goal here is to look through a set of 30 established blue chip stocks, which unlike SPY and QQQ, are easy to run through quickly (there’s only 30 stocks in DIA to chart). And, I know I’ll come across at least one stock in most S&P 500 sectors. DIA is much more spread out in those terms, versus SPY and QQQ which hold all sectors but most constituent stocks have no impact on performance.

I did just that, charted the 30 stocks in the Dow by pulling up DIA, clicking through to see the constituents list, then scanning the charts. I do this for DIA and hundreds of other stocks and ETFs nearly every day. And what I found was a confirmation of what I see market-wide:

There are stocks with a good chance of appreciating in the near term. However, it is a short list.

These 3 DIA Stocks Look Best Right Now

Boeing (BA) appears to be trying to bust a move higher once again. That 20-day moving average in red is saying there’s a chance. If the 50-day turns up as well, there may be more than a trading move here. A big “if” for now, but this stock looks better than most in the Dow to me. The Percentage Price Oscillator (PPO) at the bottom is still in negative territory, but turning up. I translate that to “if it can keep plugging a bit higher and cross above the 0.00 line with some energy, that could unlock a bigger move.”

Cisco Systems (CSCO) is another stock I’m watching closely. It has some similarities to the BA chart above. However, CSCO’s PPO has just crossed into positive territory. The move higher has a chance to stall at the recent high just above $72, but as I see it, if I have a trade where the first few percentage points higher do occur, I just gave myself a ton of flexibility.

United Healthcare (UNH) is by far the most intriguing of the 3. I put this one last, however, because there’s so much fundamental and narrative “noise” around the name, it could overtake the positive pattern I see building. That followed a historic loss for the stock earlier this year.

The PPO on this daily chart is not “cheap,” but that doesn’t always matter. SPY has looked like that for a while and it keeps notching new highs. But UNH looks more like a story that will play out very gradually and not in a straight line. I’m intrigued enough to include it here, and to follow it with an eye toward writing about it solo in the near future, once more technical evidence appears on the chart in multiple time frames.

Don’t doubt the Dow. I think it will always be a hunting ground for traders and investors. Even if its main use eventually becomes the place we go to remind ourselves that not every stock is an “AI play.”

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.